© Gianella Castro

Overview

Peru is a land of skyscraping peaks, vast jungle, and multilayered archaeology. From the world’s tallest tropical mountain and highest navigable lake to rich biodiversity that ranks among the globe’s greatest, Peru offers both natural and cultural wonders. History seekers can explore Caral-Supe, the oldest-known civilization in the Americas, alongside ancient marvels like Kuélap and Chavín de Huántar, while adventurers can trek rugged Andes trails, wander deserted ruins, or swing from a hammock deep in the Amazon. You’ll find endless Peru travel inspiration across its three distinct regions: the misty Pacific coast with surf beaches and prehistoric sites, the snow-dusted Andes crowned by Machu Picchu and the Cordillera Blanca, and the lush Amazon Basin stretching from Iquitos to the untouched wilderness of Pacaya-Samiria. Not sure where to start? Plan your adventure with our travel inspiration and tips covering top attractions, when to visit and expert advice.

Lonely planet’s trusted travel insurance provider

Dreaming of Peru? Protect your trip

Travel with confidence. Protect your trip and your wallet.

We don’t represent World Nomads, we receive a fee from quotes using this link. This is not a recommendation to buy travel insurance.

Take your Peru trip with Lonely Planet Journeys

Pick one of our ready-to-book trips or fully customize your own with help from our local experts.

bookable trip

Peru Uncovered: A Journey from Coast to Andes

14 days / 13 nights

highlights

- 1Embarking on a 10-hour luxury train ride through the Andes and over the Altiplano

- 2Watching llamas and vicuñas graze at the foothills of volcanic mountains

- 3Finding the sacred in the Sacred Valley, where intricate engineering reflects Incan ingenuity

from $4,895

per person

Explore more trips

Explore more trips

12 days / 11 nights

Roots of the Rainforest: Into the Heart of Peru

FROM $5,100

per person

Must-see attractions

Planning Tools

Expert guidance to help you plan your trip

Best Things to Do

From the Andes to the Amazon rainforest to the stunning coast, Peru offers endless adventure.

Read full article

Best Places to Visit

It's hard to know where to go in Peru – known for cuisine, culture and biodiversity. Let this list of 13 kickstart a visit to this South American darling.

Read full article

Best Time to Visit

Whether you're a foodie bound for Lima or an adventurer heading for the Inca Trail, find the perfect time for your Peru vacation here.

Read full article

Things to Know

Often called Machu Picchu's little sister, Choquequirao can only be reached on foot. Lonely Planet editor Melissa Yeager shows you want to expect.

Read full article

Transportation

When you invest extra time in planning your trip to Peru, you'll reap dividends. This guide will help you get around with ease.

Read full article

Money and Costs

Peru has long been a destination for backpackers on a budget and now other travelers have caught on – here's how to make your money go further on the road.

Read full article

Traveling with Kids

Every adventure-seeking family with a great appetite should have Peru on their "dream destinations" list. Here are the best things to do there with kids.

Read full article

Best Road Trips

These road trips are worth the investment and effort, from archaeological sites to jungle adventures and stunning beaches. Don't miss this version of Peru.

Read full article

Get Connected

Stay fully connected on your next trip to Peru with this guide to local wi-fi networks, roaming charges, eSIMs and data

Read full article

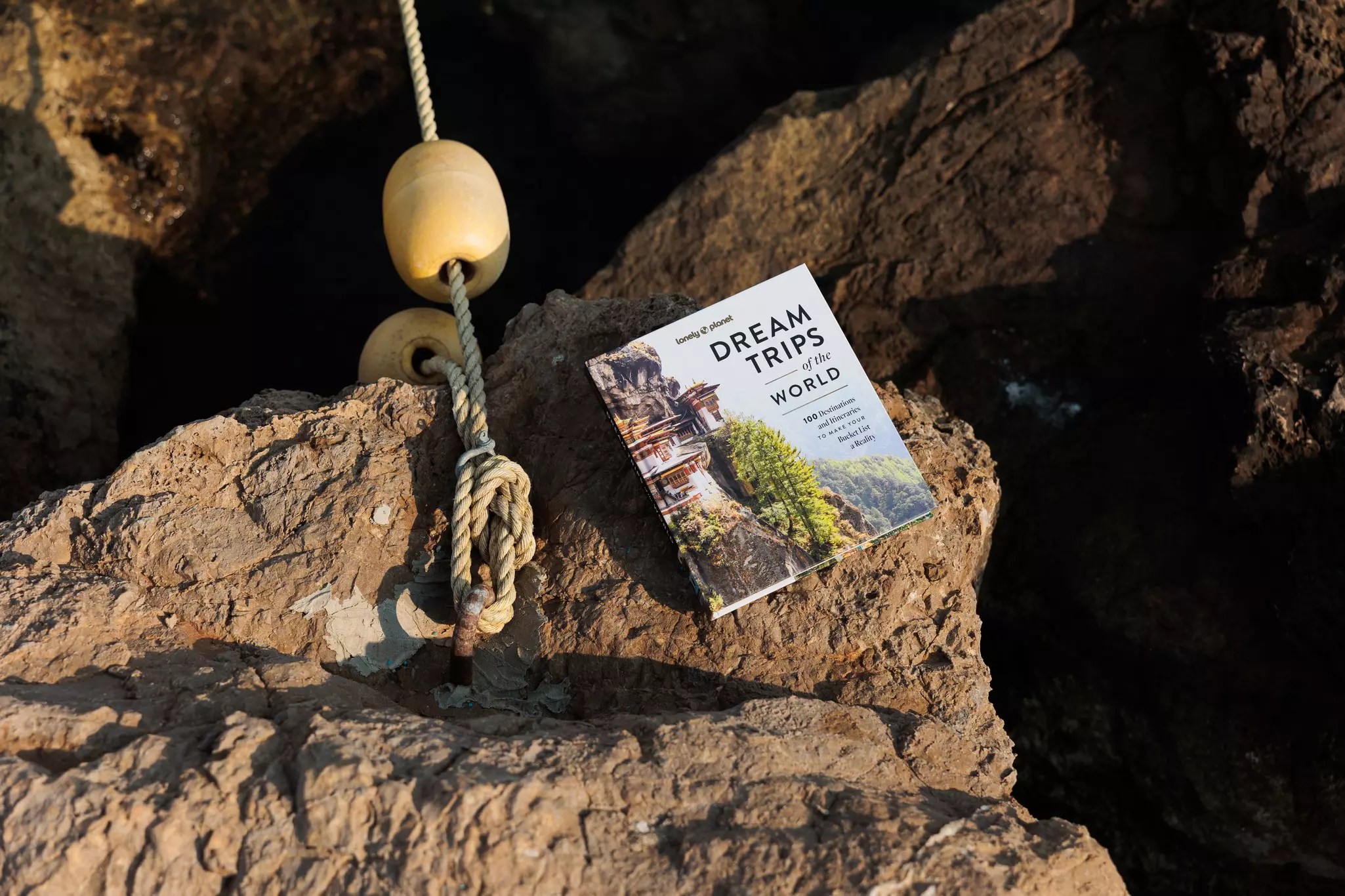

Get a book. Get inspired. Get exploring.

in partnership with getyourguide