© Scott Heaney/Shutterstock

Overview

Bright, bustling and known for its diverse dining scene, outstanding museums and happening nightlife, Toronto is a cosmopolitan city whose residents have roots across the globe.

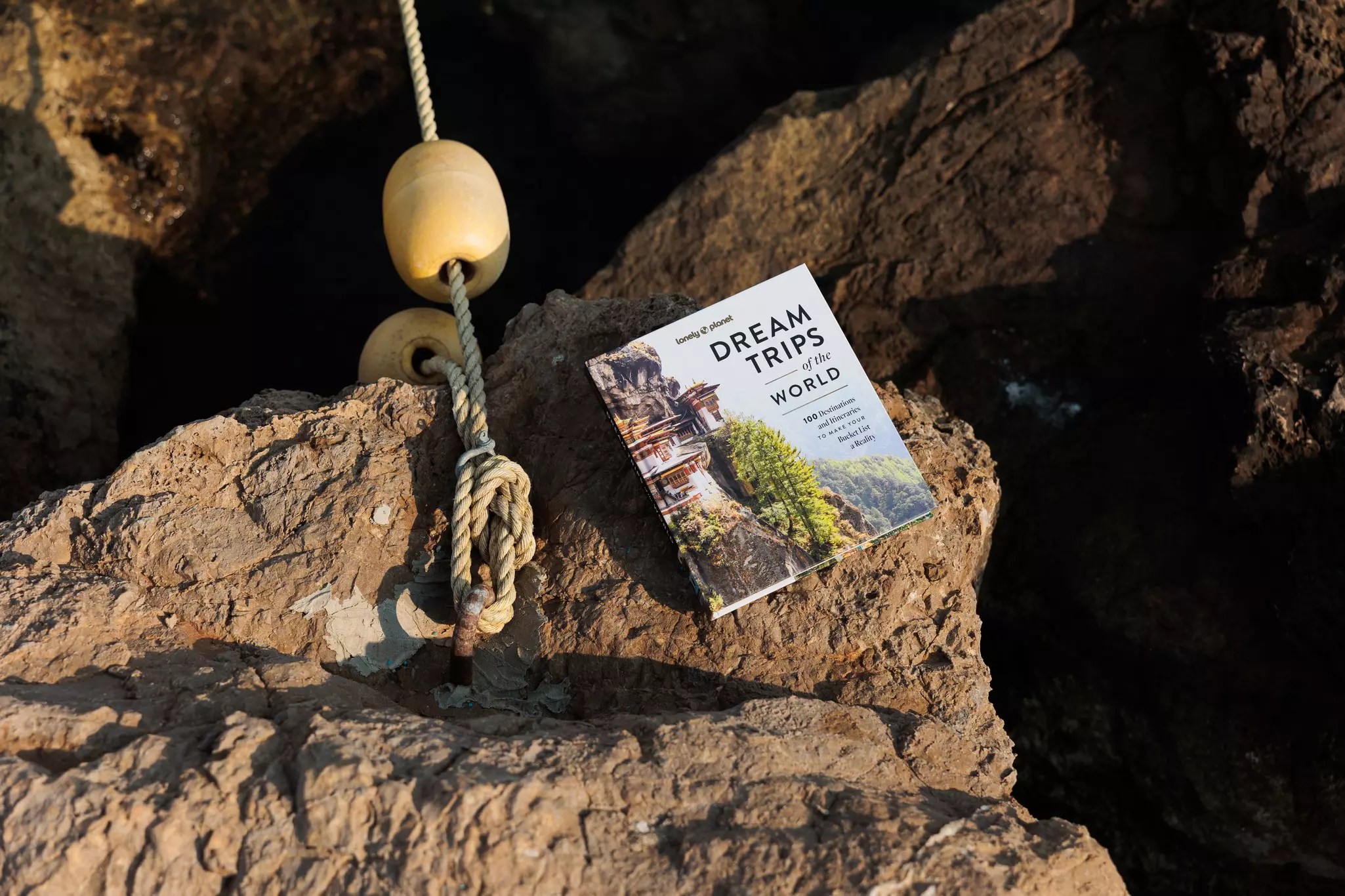

Take your Canada trip with Lonely Planet Journeys

Time to book that trip to Canada

Lonely Planet Journeys takes you there with fully customizable trips to top destinations – all crafted by our local experts.

Must-see attractions

Planning Tools

Expert guidance to help you plan your trip

Best Things to Do

From monuments to fun food tours and cool museums to chic shopping, Toronto has something to offer every traveler. Here are the top things to do.

Read full article

Best Time to Visit

Find out the places to be and the best happenings in the city with our guide to the best time to visit Toronto.

Read full article

Things to Know

While Toronto is generally easy to navigate there are a few things you should know before you go.

Read full article

Transportation

Toronto's best things to do are spread across the city, and we've got the best advice on how to get around the city easily.

Read full article

Free Things to Do

With free admission times at some museums and atmospheric historic sites that you just can't miss, these are the top free experiences in Toronto.

Read full article

Best Neighborhoods

Explore Toronto's neighborhoods one district at a time with this guide.

Read full article

Day Trips

Get out of the city and experience some of the best parts of Ontario with these top day trips from Toronto.

Read full article

Traveling with Kids

Explore the best of Toronto as a family with these kid-friendly things to do.

Read full article

5 Shops

Where to go in Canada’s largest city for delicious speciality foods, books, Canada-made gifts and more.

Read full article

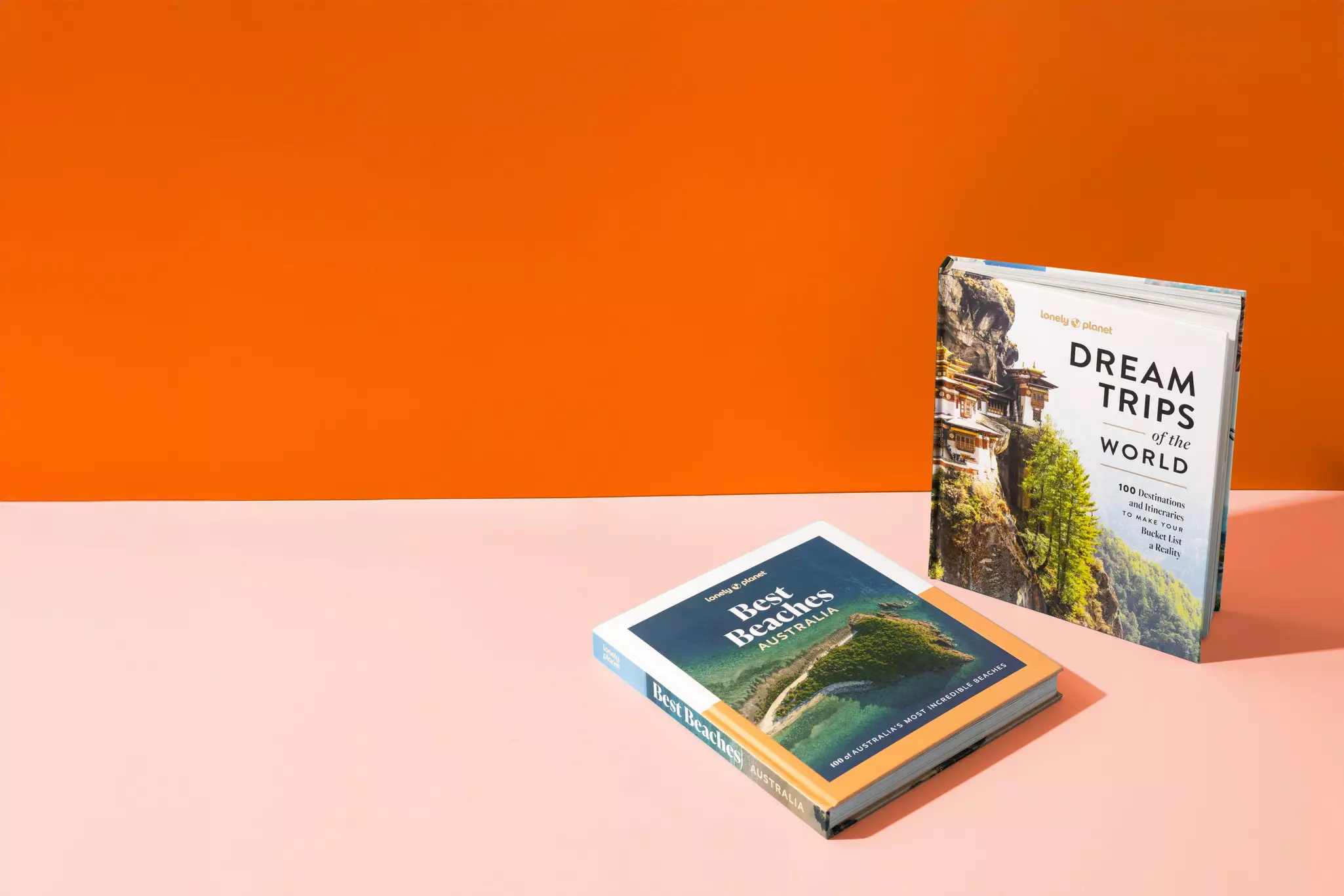

Get a book. Get inspired. Get exploring.

in partnership with getyourguide