Europe

©AleksandarGeorgiev/Getty Images

Overview

There simply is no way to tour Europe and not be awestruck by its natural beauty, epic history and dazzling artistic and culinary diversity.

Must-see attractions

Planning Tools

Expert guidance to help you plan your trip

Best Things to Do

In Europe, the next great adventure is always just a quick ferry, train ride or flight away.

Read full article

Best Time to Visit

Given that Europe shines bright all year, the decision on when to travel to Europe depends on your budget and what you hope to do while there.

Read full article

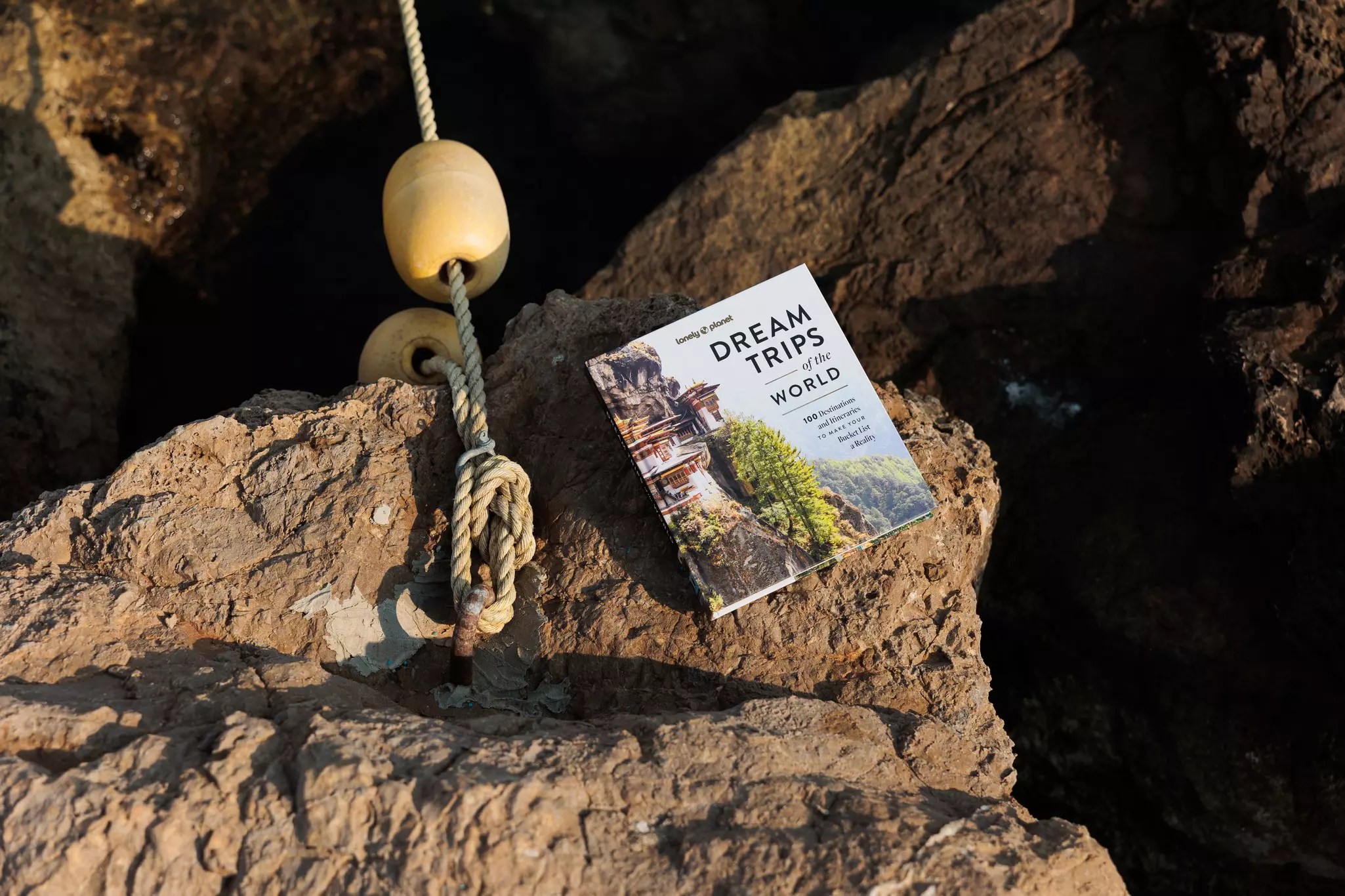

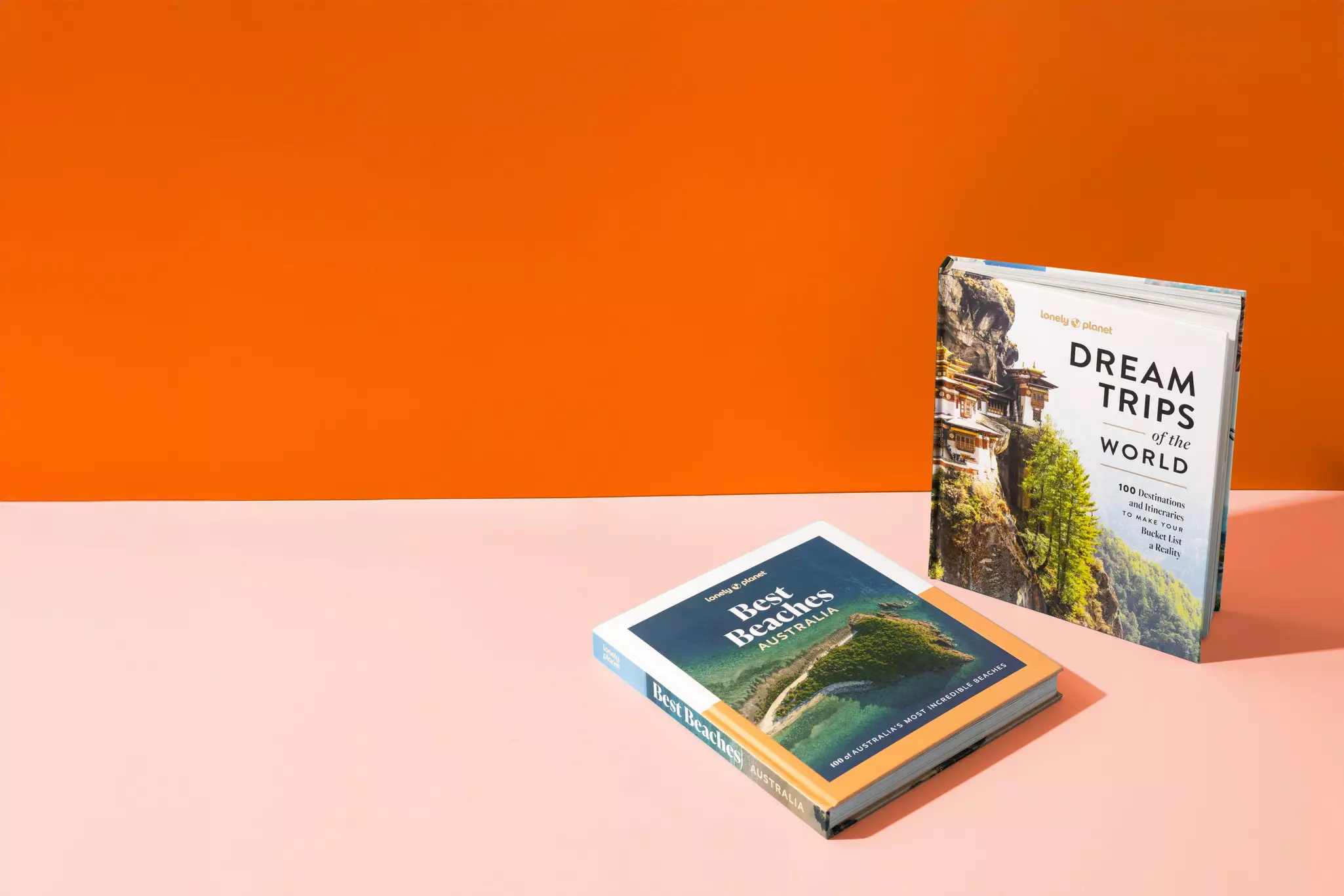

Get a book. Get inspired. Get exploring.

in partnership with getyourguide

![SWITZERLAND - JANUARY 01: Library of the monastery St. Gallen, Switzerland. 2000 hand writings, 1635 incunable and almost 100.000 books. The library was built between 1758 and 1767 und richly decorated. (Photo by Imagno/Getty Images) [St. Gallen, Schweiz: Ehemaliges Benediktiner-Kloster. Stiftsbibliothek mit 2000 Handschriften, 1635 Wiegen- und Fruehdrucken (Inkunabeln) und schliesslich 100.000 Buechern, 1758-1767 erbaut und kunstvoll ausgestattet. Stift St. Gallen: 612 Zelle des hl. Gallus, eines Gefaehrten Columbans, 719 wird durch den hl. Otmar das Kloster errichtet, das 747 die Regel Benedikts annimmt, 1805 saekularisiert.]

56463766

Abbeys, Architecture, Books, Interiors, Libraries, Photo tgg06/01](https://lp-cms-production.imgix.net/2023-06/StiftsbibliothekStGallen.jpeg?auto=format,compress&q=72&fit=crop&ar=1:1)