Getty Images

Overview

A country of dazzling diversity, Morocco has epic mountains, sweeping deserts and ancient cities, and it greets travelers with warm hospitality and the perfect glass of mint tea.

Meet your new travel partner

Stay connected in Morocco

Get unlimited data while you travel with Holafly eSIM. Peace of mind and no hidden fees wherever you go.

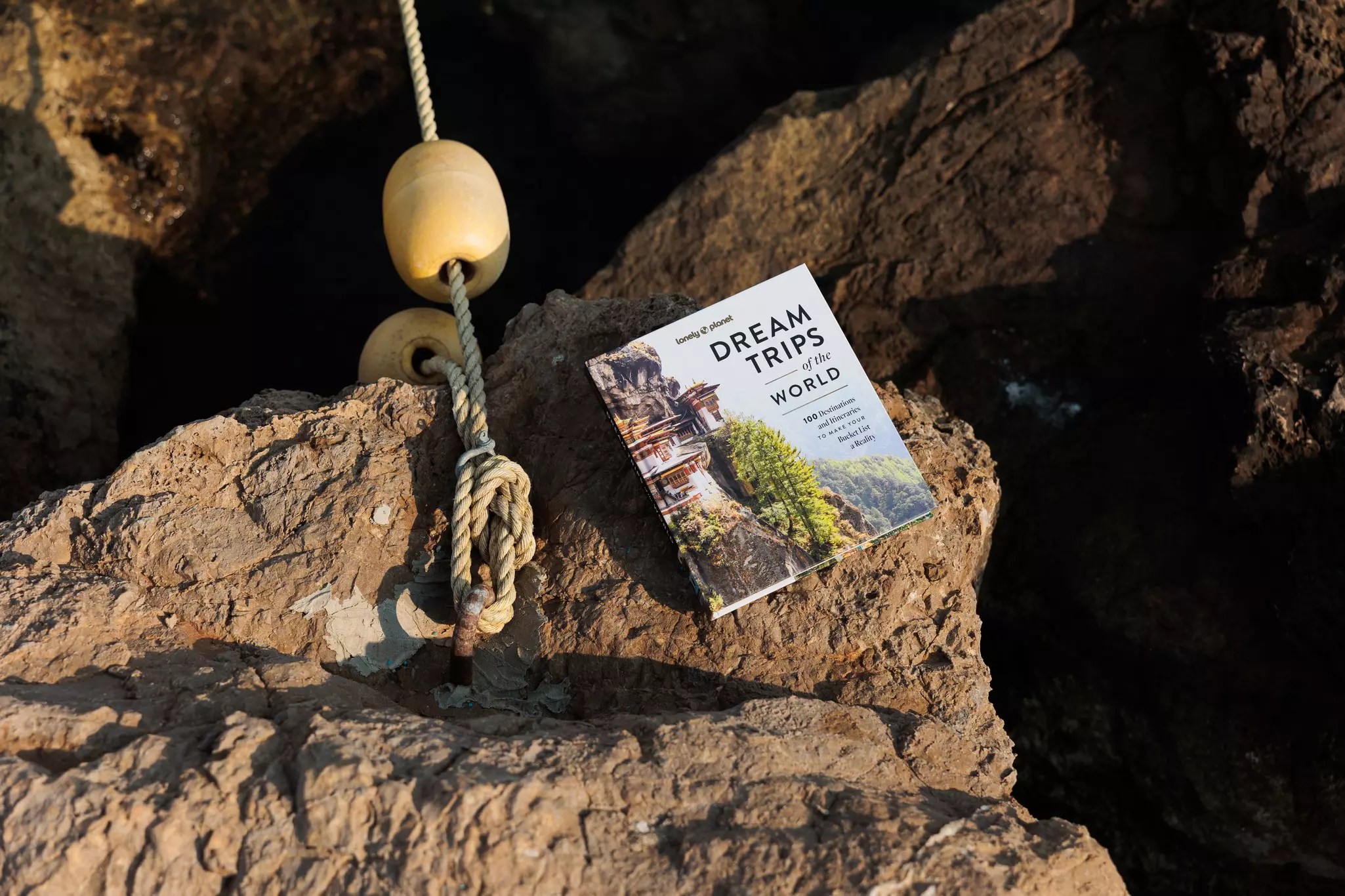

Take your Morocco trip with Lonely Planet Journeys

Pick one of our ready-to-book trips or fully customize your own with help from our local experts.

bookable trip

Meet Morocco: 10 Days in Marrakesh, Essaouira, the Atlas Mountains, and the Agafay Desert

10 days / 9 nights

highlights

- 1Riding a camel through the Agafay Desert dunes at sunset

- 2Getting lost in the labyrinthine streets of the Old Medina during a guided Marrakesh walking tour

- 3Cooking traditional cuisine in a Berber village with a local resident

from $3,750

per person

Explore more trips

Explore more trips

12 days / 11 nights

Mesmerizing Morocco: 12 Days in Rabat, Tangier, Fes, and the Sahara

FROM $4,189

per person

Must-see attractions

Planning Tools

Expert guidance to help you plan your trip

Best Things to Do

Discover the best things to do in Morocco, from mountain to desert, city to coast.

Read full article

Best Places to Visit

The dazzling diversity of mountains, deserts, beaches and ancient cities in Morocco brings your senses to life.

Read full article

Best Time to Visit

From summer music festivals to winter skiing, plan the right time for your visit to Morocco with this seasonal guide.

Read full article

Things to Know

Weave your way through the markets and medinas of Morocco with these travel tips on planning, etiquette and health and safety.

Read full article

Transportation

This dazzling diverse country offers an array of transport options to help you traverse its grand expanse.

Read full article

Visa Requirements

Find out the visa requirements for visiting Morocco, including whether you can visit the country visa-free and how long tourists are allowed to stay.

Read full article

Money and Costs

Morocco offers excellent value for travelers of all budgets. Here are our top tips to make your money go further.

Read full article

Traveling with Kids

Family travelers can expect to feel very welcome in Morocco. Here are the best things to do there with kids.

Read full article

Best Road Trips

Here are five ways to enjoy Morocco's dazzling landscape, from its rugged mountains to its sweeping Saharan desert to its wild Atlantic coastline.

Read full article

Get Connected

Morocco has it all – a storied history, amazing landscapes, a vibrant cuisine. Here's what you need to know about getting connected while you explore.

Read full article

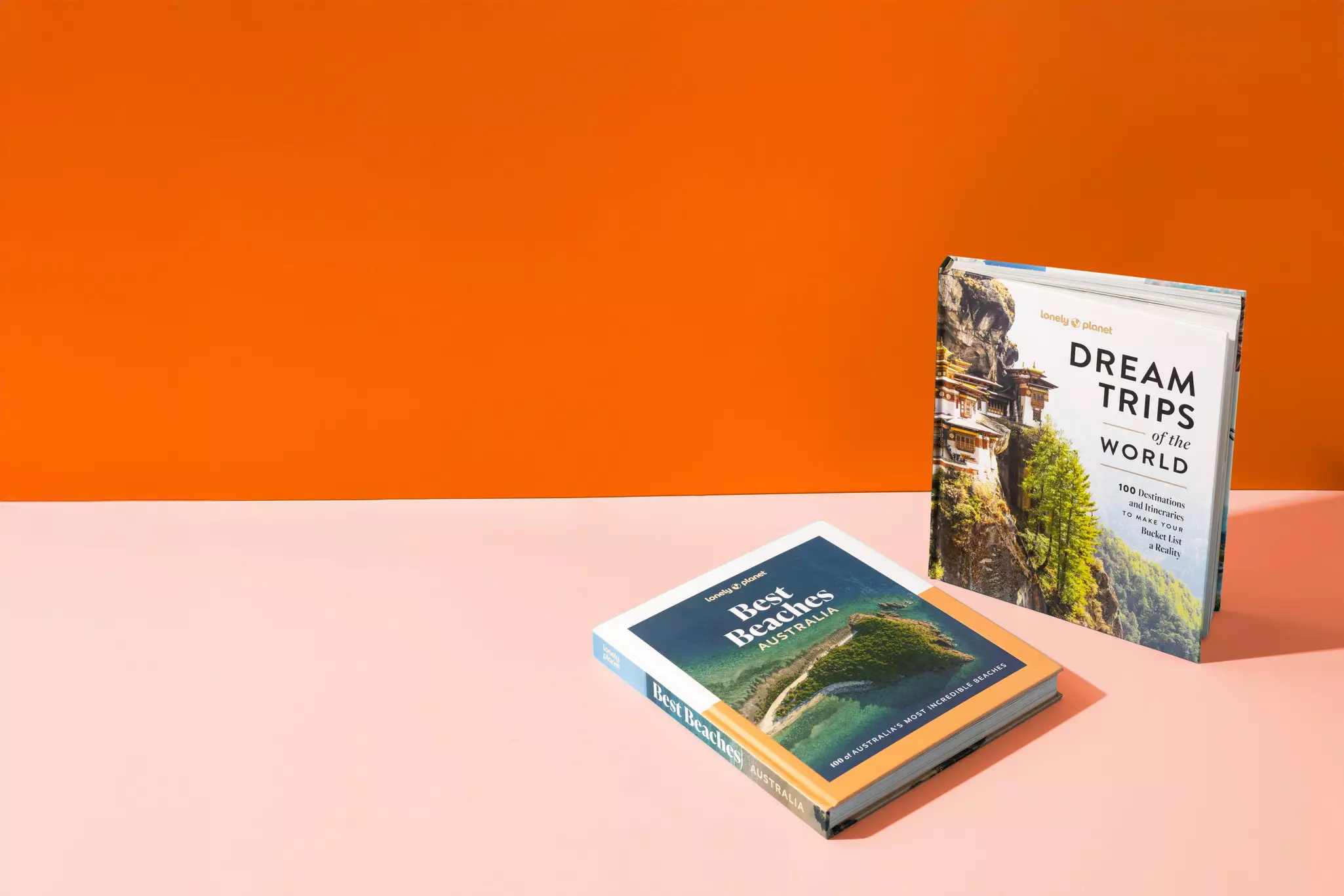

Get a book. Get inspired. Get exploring.

in partnership with getyourguide