Robert Ormerod for Lonely Planet

Overview

A small island with a memorable punch, Ireland's breathtaking landscapes and friendly, welcoming people leave visitors floored. You'll want to go back for more.

Lonely planet’s trusted travel insurance provider

Dreaming of Ireland? Protect your trip

Travel with confidence. Protect your trip and your wallet.

We don’t represent World Nomads, we receive a fee from quotes using this link. This is not a recommendation to buy travel insurance.

Take your Ireland trip with Lonely Planet Journeys

Pick one of our ready-to-book trips or fully customize your own with help from our local experts.

bookable trip

Icons of Southern Ireland: 12 Days in Dublin, Kinsale, Cork, and Tipperary

highlights

- 1Viewing the illuminated Book of Kells in Trinity College Dublin’s Old Library

- 2Partaking in a traditional afternoon tea inside Waterford’s famous crystal factory

- 3Foraging for wild seaweed with an expert guide on the Ring of Kerry

from $5,700

per person

Must-see attractions

Planning Tools

Expert guidance to help you plan your trip

Best Things to Do

From spectacular swims to dramatic coastal vistas and charming castles, Ireland offers many fantastic adventures and places to visit.

Read full article

Best Places to Visit

These 11 beautiful destinations in Ireland help ensure a memorable visit that suits every season and mood, making the most of the small European island.

Read full article

Best Time to Visit

From summer sun and fabulous festivals to off-season bargains and crowd-free attractions, here's everything you need to know about when to visit Ireland.

Read full article

Things to Know

Lonely Planet writer and Ireland native, Fionn Davenport, shares his top 10 tips to have the best time in Ireland.

Read full article

Transportation

You don’t need a rental car to explore the Emerald Isle. Here are all the options for getting around beautiful Ireland.

Read full article

Visa Requirements

Who wouldn't jump at the chance to visit the Emerald Isle? Here’s how to check if you need a visa before setting off on your Irish adventure.

Read full article

Money and Costs

There are plenty of ways to make your money go further during your visit to Ireland. Read on for our local expert tips.

Read full article

Traveling with Kids

With its bounty of natural attractions, outdoor adventures and cultural sites, Ireland is packed with family-friendly activities. Here are our top picks,

Read full article

Best Road Trips

What’s the best way to get the best of the natural beauty and famous charm of Ireland? Hit the (rural) road on these top road trips.

Read full article

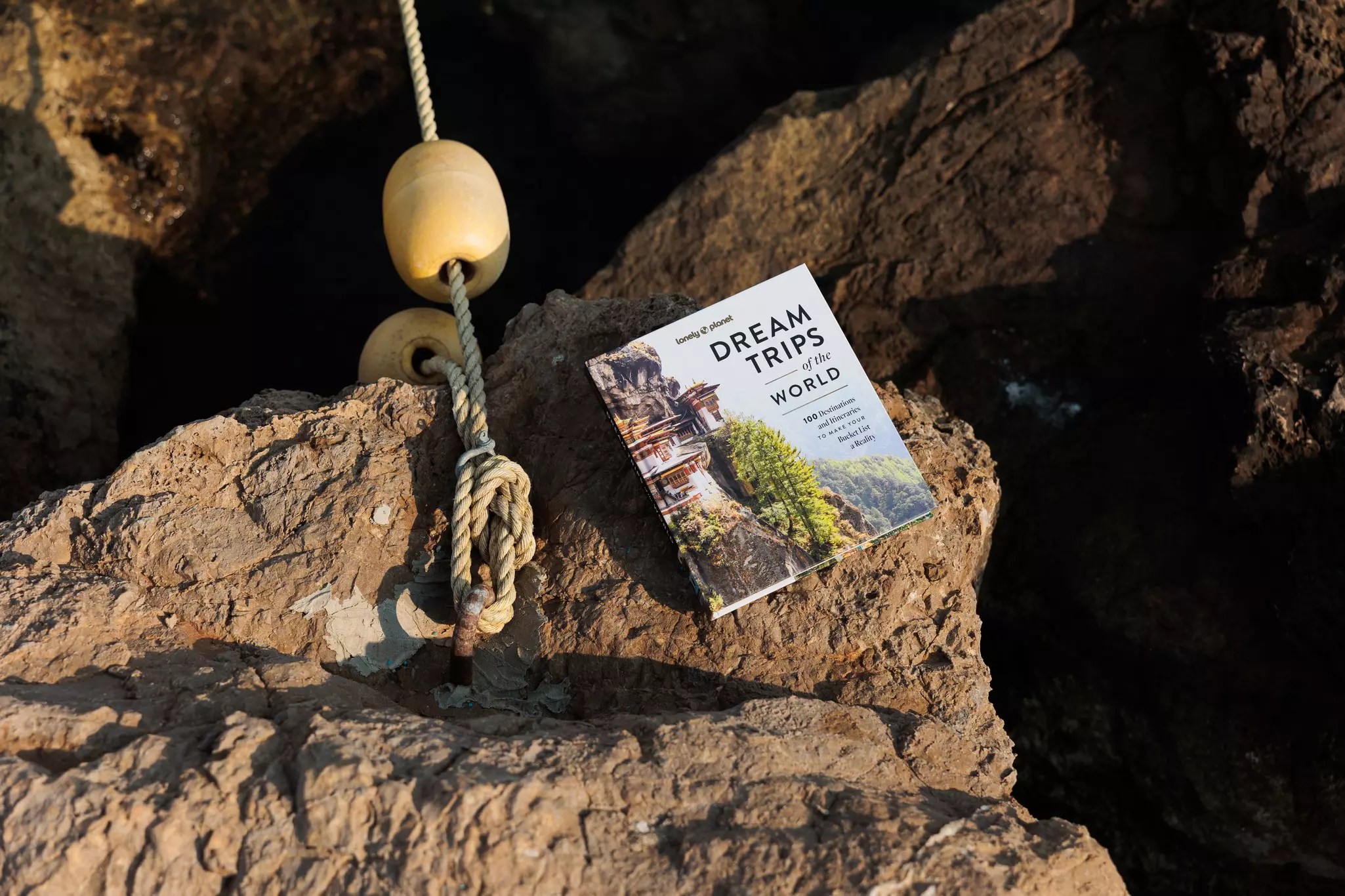

Get a book. Get inspired. Get exploring.

in partnership with getyourguide